Latest news, podcasts and updates.

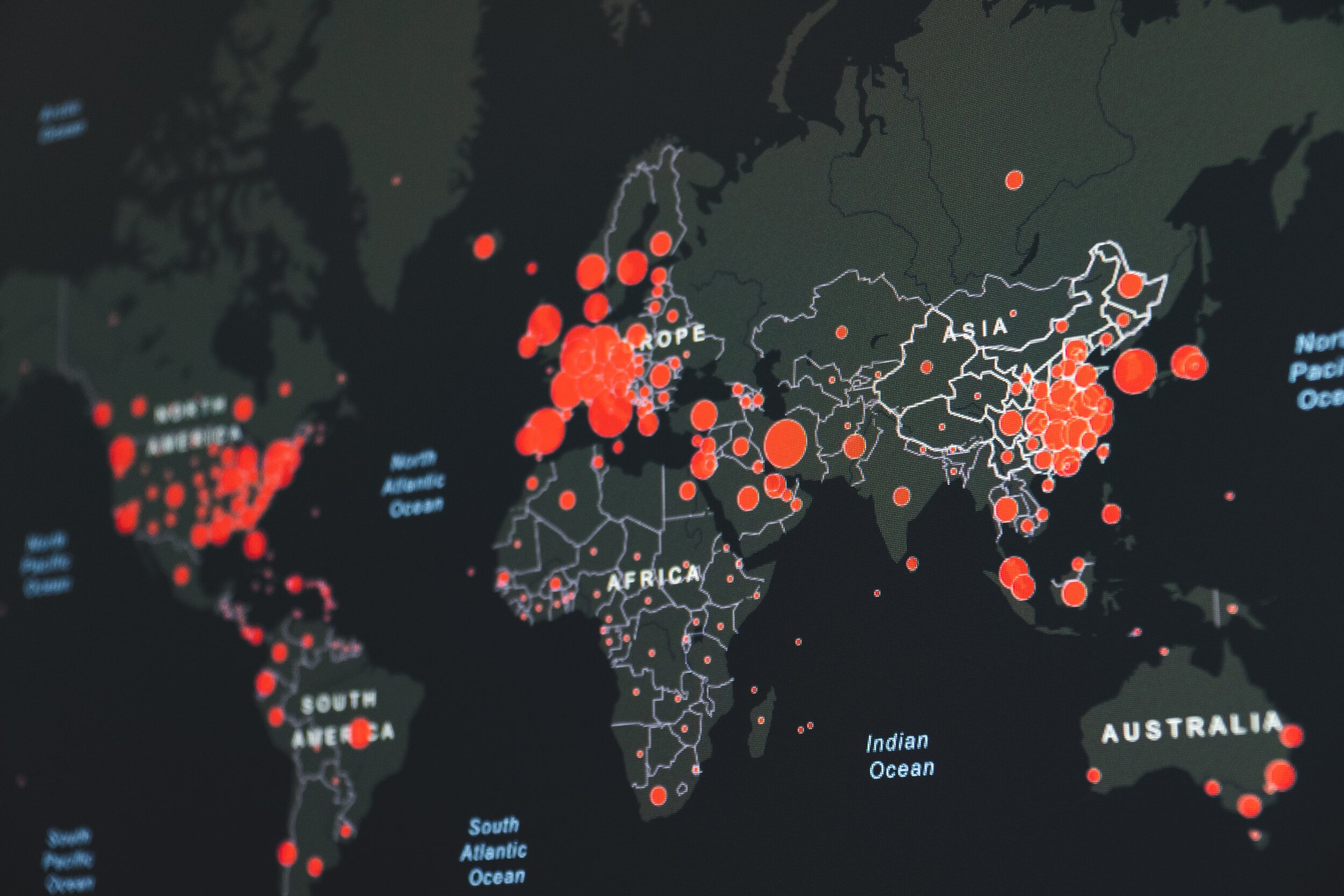

The world is complex, it’s constantly evolving and adapting.

Our market and economic updates aim to keep Lifewealth clients informed of not only what changes are happening, but how we’re reacting to those changes.

Our goal is to illustrate, in an accessible way, that the balance between shifting short-term noise and long term strategies is as similar for economies, as it is for your own financial circumstances.

Economic and Market Update: Low interest rate environment

Head of Investment Committee James Vandeloo and Chief Executive Officer Jason Hardwood discuss the ongoing impact of COVID-19 and the implications of the low interest rate environment on portfolios and client objectives.

Economic and Market Update: Evolving conditions from COVID-19

Head of Investment Committee James Vandeloo and Chief Executive Officer Jason Harwood discuss the evolving market conditions during the period of COVID-19.

Economic and Market Update: Easter break check-in

Head of Investment Committee James Vandeloo and Chief Executive Officer Jason Harwood give an update on the evolving market conditions around the Coronavirus.

Economic and Market Update: Evolving market conditions

Head of Investment Committee James Vandeloo and Chief Executive Officer Jason Harwood give an update on the evolving market conditions around the Coronavirus.

Economic and Market Newsletter: Coronavirus

James Vandeloo, Head of the Lifewealth Investment Committee, provides another update on global markets and the outlook for investment portfolios in this COVID-19 period and beyond.

Tax Update: Coronavirus relief packages

Over the weekend the Federal and State Governments both announced additional relief packages and other measures that will be of benefit to our small business clients and, to some extent, retirees.

Economic and Market Update: Coronavirus

Head of Investment Committee James Vandeloo and Chief Executive Officer Jason Harwood give an update on the impacts of Coronavirus to finance and investment markets.

Tax Update: Business incentives

The government have increased the instant asset write off threshold from $30,000 to $150,000 and expanded the programme access to include businesses with aggregated annual turnover of less than $500 million until 30 June 2020.

Economic and Market Update: Coronavirus update

Head of Investment Committee James Vandeloo and Chief Executive Officer Jason Harwood discuss how Governments and central banks around the world are taking action, and the impacts on markets.

Economic and Market Newsletter: Coronavirus

Wow, what a difference a few weeks can make! Less than 3 weeks ago I attended an investment conference where a major topic of discussion was the impact the Coronavirus would have on the global economy and financial markets in 2020.